Next-Generation High-Bandwidth Memory (HBM) Demand Surges: Samsung, SK Hynix, and Micron Sold Out for 2024

Key Takeaways:

- Record Demand: The production capacity for next-generation high-bandwidth memory (HBM) is nearly sold out for 2024 among leading manufacturers.

- Strategic Expansion: Companies are exploring ways to expand production capabilities to meet growing customer demand.

- Strong Revenue Growth: HBM sales have significantly contributed to record revenues for the involved firms.

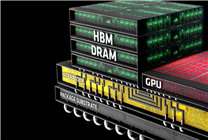

On October 31, reports surfaced indicating a dramatic surge in demand for next-generation high-bandwidth memory (HBM) among major tech companies like Samsung, SK Hynix, and Micron. This burgeoning demand is primarily due to advancements in technology and a growing need for high-performance computing solutions.

Samsung recently confirmed that it has sold out its entire production capacity for next year’s HBM4. Kim Jae-joon, the executive vice president of Samsung’s storage division, announced this during the company’s earnings conference. Earlier in the third quarter, the company successfully initiated shipments of its highly anticipated HBM3E to Nvidia—a move that has only heighted its credibility in the market.

In light of the surging customer demand, Samsung has significantly ramped up its HBM production capabilities for 2024. However, the company notes that even these enhancements have not been sufficient to keep pace with the overwhelming demand. As a result, Samsung is currently exploring additional measures to expand production further to accommodate this growth.

SK Hynix has also witnessed remarkable success, as HBM has become a crucial revenue driver for the company. The firm’s revenue reached record levels in the third quarter, driven by robust sales of HBM3E high-capacity video memory and DDR5 server memory. This performance underscores the vital role that HBM plays in the company’s product line.

SK Hynix has completed its negotiations concerning HBM supply for next year, with plans to begin shipments of HBM4 in the fourth quarter of this year. The company is optimistic about expanding its sales fully in the upcoming year, further solidifying its place in the HBM market.

Micron, which commands roughly one-third of global DRAM and HBM production, has echoed similar sentiments. The company announced that its HBM orders for next year’s production have been nearly sold out as well. CEO Sanjay Mehrotra highlighted that Micron is currently working with six customers who have secured significant pricing agreements for the majority of their HBM3E supplies through 2026.

As Micron moves forward, it is actively negotiating terms regarding HBM4 specifications and quantities with its clients, suggesting that the company expects to finalize agreements soon. This proactive approach aims to ensure the complete sale of its remaining HBM supply for the foreseeable future.

Chief Commercial Officer Sumit Sadhana noted the critical shortages faced by customers in the market. He pointed out that these shortages have led to improved margins, indicating an upward trend in profitability for the company as demand continues to exceed supply.

The overall landscape for high-bandwidth memory production is changing rapidly as companies like Samsung, SK Hynix, and Micron ensure their offerings meet the evolving needs of technology. As the push for more advanced computing solutions continues, the demand for HBM is expected to grow even further, making it one of the focal points for revenue generation within the semiconductor industry.

In conclusion, 2024 promises to be a pivotal year for high-bandwidth memory production, as leading manufacturers capitalize on the rising demand and navigate the complexities of supply chain management. The competitive landscape for HBM promises innovation, collaboration, and an increased focus on meeting the exigent needs of a technology-dependent world.

This strategic overview of the HBM market showcases the evolving dynamics among leading manufacturers, illustrating how the interplay between demand and supply can significantly shape the future of computing technologies.