The Latest Chip Innovations: A Competitive Landscape Ahead of Price Hikes

Summary:

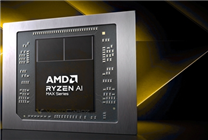

- The release of Apple’s iPhone 17 series is accompanied by new processors: MediaTek’s Dimensity 9500 and Qualcomm’s Snapdragon 8 Elite Gen 5.

- Manufacturing costs are rising, with TSMC’s N3P process seeing a 20% increase on average, impacting flagship smartphone prices.

- Upcoming Android devices, including Xiaomi and OPPO models, are also expected to experience price increments due to heightened production costs.

On September 22, following the release of Apple’s iPhone 17 series, the competitive smartphone landscape is further amplified by the introduction of MediaTek’s Dimensity 9500 and Qualcomm’s Snapdragon 8 Elite Gen 5. These advanced processors represent the peak of innovation from both Apple and Android camps, each infused with cutting-edge technology.

The New Era of Processing Power

All three flagship processors harness TSMC’s N3P manufacturing process—an enhancement over the previous generation of chips that has already set the stage for performance and efficiency breakthroughs. TSMC’s N3P process indicates a third-generation refinement of its 3nm technology, underscoring the industry’s ongoing quest for faster and more power-efficient processors.

However, not all developments are positive. Recent reports indicate a rise in the OEM pricing of the N3P process ranging between 16% and 24%. This translates to an approximate average price increase of 20%, prompting significant ramifications for the launch costs of new flagship devices.

Impact on Smartphone Prices

While Apple maintained the pricing of its standard iPhone 17 model, the premium iPhone 17 Pro series saw an increase of $100 in the U.S., and a 1,000 yuan rise in domestic markets. As the trend evolves, upcoming flagship Android smartphones—including models from Xiaomi, OPPO, and Vivo—are also likely to experience price hikes. This situation raises questions about the potential for consumers to adapt to increased price points as manufacturers navigate fluctuating production costs.

Rising Manufacturing Costs

The concerning trend does not end with TSMC’s N3P pricing. Expectations for the forthcoming 2nm process, which will see models such as Apple’s A20, MediaTek’s Dimensity 9600, and Qualcomm’s Snapdragon 8E6 hit the market, likewise portend even steeper costs. Current estimates suggest that the pricing for this next-generation technology may surge by approximately 50%, escalating from $20,000 to a staggering $30,000.

In addition to these hardware costs, there is a noticeable increase in memory and flash storage prices. Major manufacturers have reported rises ranging from 10% to 30%, with predictions that this trend will persist into at least the second quarter of the coming year. Consequently, even entry-level Android smartphones may begin at price points of $4,999 to $5,499—potentially reshaping market expectations.

Conclusion: Future Challenges in a Competitive Market

As we witness the rapid evolution of smartphone technology with the launch of the iPhone 17 series and competing processors from MediaTek and Qualcomm, the rising costs associated with these advancements could serve as a pivotal challenge for manufacturers and consumers alike. While exciting innovations are on the horizon, the economic implications of these trends warrant careful consideration by industry stakeholders.

The anticipated adjustments in smartphone pricing, stemming from manufacturing costs, will undoubtedly influence purchasing decisions. In an increasingly competitive market, companies will need to balance delivering cutting-edge technology while remaining accessible to consumers concerned about rising costs. As we move forward, keeping an eye on these evolving dynamics will be crucial for both consumers and industry professionals.

In conclusion, as the smartphone industry gears up for a new wave of cutting-edge devices complemented by high-performance processors, the impacting costs are likely to reshape market strategies and consumer choices for the upcoming year.