NVIDIA’s Strategic Move: Acquiring Intel’s Data Center CPU Rights

Key Highlights:

- NVIDIA has secured rights to customize Intel’s x86 CPU for $5 billion, integrating RTX GPU capability.

- Intel remains committed to its GPU initiatives, particularly in the Ruixuan series.

- NVIDIA continues to invest in ARM architecture, emphasizing diversification in its product roadmap.

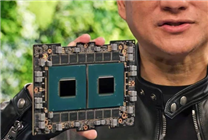

On September 21, it was announced that NVIDIA will acquire the rights to customize Intel’s x86 CPUs for the data center market at a cost of $5 billion. This strategic partnership allows NVIDIA to blend its state-of-the-art RTX GPU technology into consumer-grade x86 CPUs, a fusion that is poised to reshape the data center landscape significantly.

Despite this bold move, Intel has firmly stated its commitment to the Ruixuan GPU line, dimensioning the competitive landscape. Analysts are now left to ponder whether this acquisition will enable NVIDIA to deliver superior x86 CPUs that could potentially overshadow its existing ARM architecture, and moreover, whether NVIDIA will remain a contender in the PC market.

The question regarding NVIDIA’s ARM processors was addressed by CEO Jensen Huang during a recent joint press conference. Huang remarked, “Of course, we have been building ARM processors, such as the latest Thor for robotics and autonomous driving. We are also excited about our upcoming N1 series ARM processors that will be integrated into the DGX Spark AI supercomputer and various other products. This investment in Intel will not hinder our ARM development.”

This statement underscores NVIDIA’s strategy of diversification rather than relying solely on one architecture. The continued commitment to the development of ARM CPU products signals that NVIDIA is not putting all its resources into x86 technologies.

Huang’s remarks effectively confirm that NVIDIA is focusing on dual architecture products. For example, the N/N1X processors for laptops and the GB10 processors for desktop workstations are fundamentally aligned, leveraging both ARM and Blackwell GPU architectures. However, subtle differences in specifications and market positioning do exist.

The GB10 workstations are now entering the market, competing directly with AMD’s Strix Halo series. While they boast the competitive advantage of an extensive CUDA ecosystem, they also face the challenge of being priced in the higher range—often between 30,000 and 40,000 yuan.

On the other hand, the N1 series notebooks are reportedly facing delays, anticipated to launch at the end of next year. The challenge lies in effectively meeting the consumer ecosystem’s demands, an issue that also plagues competitors, such as Qualcomm with its Snapdragon lineup.

Moreover, as NVIDIA expands its footprint in data centers and AI, the company has developed its CPU offerings to complement its AI GPUs. Currently, this includes the Grace CPU, with plans for the next generation, Vera, on the horizon.

The landscape of CPU architecture is rapidly evolving, with NVIDIA striving to maintain a robust presence across both x86 and ARM platforms. The integration of GPU technology into their processors is a significant step that may redefine efficiency and performance standards within the computational landscape.

As this situation continues to unfold, industry observers are keenly watching to see how NVIDIA’s strategic acquisitions and innovative product developments will affect market dynamics. Will NVIDIA further consolidate its position or face challenges from rivals adapting to this new era of technological integration?

In conclusion, the strategic acquisition by NVIDIA reflects a broader trend in the tech industry where collaboration and diversification are pivotal for staying ahead in an ever-competitive market. By extending its reach into both Intel’s x86 technology and its own ARM-based solutions, NVIDIA is strategically positioning itself for the future.