The Competitive Landscape of Memory Manufacturing: Domestic Players Rise Amid Price Hikes

Summary

- International manufacturers like Samsung are raising memory prices, while domestic companies engage in aggressive price competition.

- Changxin Technology’s 32GB DDR4 memory is significantly cheaper compared to major rivals, attracting consumer interest.

- Despite potential partnerships with PC giants like HP, certification for domestic memory products is still pending, highlighting ongoing concerns over quality and supply stability.

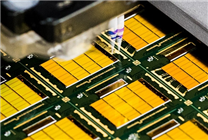

Overseas manufacturers, particularly industry leaders like Samsung, have recently escalated memory pricing, impacting the global market dynamics. In stark contrast, domestic companies are embracing a robust price-cutting strategy to capture market share. This burgeoning competition is likely to reshape the landscape of memory manufacturing, albeit significant hurdles remain before widespread acceptance among major PC manufacturers.

In a noteworthy development, Changxin Technology has introduced its 32GB DDR4 memory module at an attractive price point of just $138. This offering stands in stark contrast to similar products from established brands, which can cost nearly three times as much. Such pricing underlines Changxin’s strategic position, aiming to appeal to budget-conscious consumers and potentially disrupt the market established by major players.

In light of these developments, even significant PC manufacturers are beginning to explore domestic memory solutions in a bid to optimize operational costs. Reports indicate that HP, one of the largest global PC manufacturers, is in the process of certifying Changxin’s memory. There is also speculation that other notable manufacturers, such as Asus and Acer, may join this trend, further indicating a shift towards domestic suppliers.

However, this narrative faces challenges, as recent statements from industry insiders suggest that claims of product certification by HP and others have been overstated. Sources close to Changxin have since clarified that official certification processes have yet to commence, casting some doubt on the immediate viability of domestic memory products as a mainstream option.

The complexity of the memory market is further compounded by the fact that Changxin is currently navigating the intricacies of an Initial Public Offering (IPO). Their application documents lack definitive information regarding plans for international expansion, leaving many questions unanswered about future operational strategies.

As it stands, while there could be tentative discussions between Changxin and major PC manufacturers, substantive progress has not yet been made towards the certification of their products. PC manufacturers prioritize not only competitive pricing but also the crucial factors of memory quality and supply reliability. Currently, these quality assurance issues remain unresolved, suggesting that it may still be some time before Changxin’s memory products find their way into laptops and desktops produced by major companies.

Despite these challenges, the overall trend towards increased production capabilities among domestic memory manufacturers is encouraging. Unlike global competitors Samsung, SK Hynix, and Micron, which have opted to maintain high profit margins through limited production expansion, domestic players are ramping up manufacturing capabilities. This aggressive stance positions them to capture a growing share of the market, particularly as they continue to enhance the quality and reliability of their offerings.

In conclusion, while the current landscape presents significant obstacles for domestic memory manufacturers seeking certification and acceptance among top PC brands, the trajectory indicates a promising future. With competitive pricing and a commitment to expanding production capabilities, these companies can disrupt established norms within the memory sector. As domestic memory continues to evolve and gain traction, it remains to be seen how quickly it can establish itself as a reliable alternative to its overseas counterparts.

In the evolving memory market, understanding these dynamics will be crucial for consumers and manufacturers alike as they navigate the complexities of pricing, quality, and supply stability.