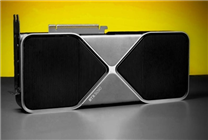

Rising Memory Chip Prices: A New Era of SSD Hard Drive Scarcity

Key Takeaways:

- Memory chip prices have nearly doubled, significantly impacting 32GB and 48GB memory upgrades.

- Large-capacity SSDs (8-30TB) have seen price increases of 25%-40%, with shortages continuing.

- Major manufacturers are prioritizing profits over increasing production capacity, indicating a prolonged scarcity of low-priced SSDs.

The landscape for memory chips is rapidly shifting, marked by a dramatic increase in prices that has implications for consumers and businesses alike. Recent reports indicate that the cost of upgrading memory, particularly for 32GB and 48GB options, has nearly doubled. This surge is not limited to just memory modules; the price of SSD hard drives has also experienced significant hikes, with customers now finding that a 2TB SSD is often priced similarly to a 1TB alternative.

The Trouble with Flash Memory

The situation for flash memory is even more precarious. Many industry experts warn that low-priced SSD hard drives are becoming increasingly rare, and such products may not return to the market for over a year. The global production of flash memory chips is primarily dominated by a few key players in South Korea, Japan, and the United States, notably SK Hynix and Samsung, who together form a duopoly in the memory and flash memory sectors.

Amidst rising costs, both SK Hynix and Samsung have adjusted their production strategies. SK Hynix, for example, has opted to redirect some production lines originally dedicated to flash memory towards more lucrative memory production. This pivot indicates a strategic approach to navigating the current supply and demand challenges.

A Shift in Demand Patterns

Among SSD products, those with larger capacities are attracting greater attention from consumers. Recent price analysis shows that the cost of SSDs ranging from 8TB to 30TB has surged by 25% to 40%. Despite these price increases, demand continues to outstrip supply. Organizations investing in data center infrastructure are spending tens of billions of dollars and cannot afford to wait for hard drives to become available.

Interestingly, while shortages are driving up prices, companies like SK Hynix and Samsung are not inclined to boost production capacities. A history of overcapacity over the last two years has adversely affected their profit margins. Today, it seems these giants prefer to capitalize on the current market landscape and enjoy higher profits rather than risk profitability by ramping up production.

Industry-Wide Stagnation

This cautious approach is not exclusive to SK Hynix and Samsung. Several other flash memory producers, including Micron, Kioxia, and SanDisk, are also holding steady on their production levels. Collectively, these companies appear to have reached a tacit agreement to avoid reducing production capacities to compete for market share. Instead, the prevailing sentiment is to maximize profits in the short term, as the construction of additional production capacity could take one to two years.

Experts predict that the situation will stabilize only by 2027. Until then, consumers and companies alike will need to adapt to a climate of rising prices and limited availability. The takeaway is clear: the era of affordable SSD hard drives is coming to an end, as the consequences of these production decisions ripple through the supply chain.

Conclusion

The memory chip industry is undergoing a significant transformation, driven by rising costs and shifting production strategies. As the demand for large-capacity SSDs surges, consumers may soon find themselves facing higher prices and limited choices. Stakeholders in the tech industry should prepare for a protracted period of price inflation and inventory scarcity, altering both consumer purchasing behavior and business investment strategies.

In this evolving landscape, staying informed about market trends will be crucial for anyone involved in tech procurement or investment. With manufacturers prioritizing profitability, the market is unlikely to return to pre-inflation norms quickly, setting the stage for a challenging yet intriguing phase in the memory chip segment.