Samsung and SK Hynix to Cut NAND Flash Memory Production in 2026

Summary:

- Samsung Electronics and SK Hynix will reduce NAND flash memory production in response to changing market dynamics.

- The decision may tighten supply for servers, PCs, and mobile devices but improve the profit margins for manufacturers.

- Trending prices are expected to rise significantly due to the production cutbacks.

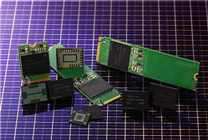

The demand for storage solutions has seen a significant surge, driven largely by advancements in artificial intelligence (AI). In light of this demand, leading South Korean manufacturers Samsung Electronics and SK Hynix, who dominate over 60% of the global NAND flash memory market, have announced further production cuts scheduled for 2026.

This strategic move comes despite promising market conditions, reflecting a complex interplay of profitability and competition within the tech industry.

Implications for the Market

While the production cuts may exacerbate the supply constraints across various sectors—including servers, personal computers, and mobile devices—these actions also indicate a potential enhancement in the profit margins for these two major manufacturers. Reports suggest that Samsung plans to lower its anticipated NAND flash memory wafer output from 4.9 million wafers in 2025 to approximately 4.68 million in 2026. Similarly, SK Hynix is projecting a reduction in production from 1.9 million units in 2025 to 1.7 million units.

Key Reasons Behind Production Reductions

Industry experts have identified three primary factors influencing this decision:

-

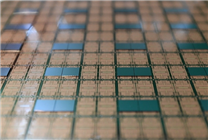

Higher Profitability of DRAM: Current market conditions indicate that the profitability of DRAM (Dynamic Random Access Memory) greatly exceeds that of NAND flash memory. As a result, these manufacturers are favoring investment in DRAM production over NAND, leading to decreased capacity for flash memory.

-

Transition to QLC Architecture: Storage manufacturers are shifting from traditional TLC (Triple-Level Cell) architecture to QLC (Quad-Level Cell) designs, more suited for large-capacity SSDs (Solid State Drives) that are increasingly in demand for AI data centers. This transition naturally impacts production levels as manufacturers work to optimize yields during the upgrade.

- Low-Price Competition from Domestic Manufacturers: Competitors such as Yangtze Memory have ramped up NAND flash memory production since 2025, employing aggressive pricing strategies to penetrate the market. This pressure from emerging players has prompted Samsung and SK Hynix to adopt a more defensive posture by limiting their general-purpose NAND flash supply.

Price Trends and Market Dynamics

This calculated reduction in production capacity has led market analysts to predict notable price increases for NAND flash memory. TrendForce estimates a potential surge in contract prices by 33% to 38% month-on-month sometime in the first quarter of 2026, attributing this expectation primarily to the conservative production approaches undertaken by both Samsung and SK Hynix.

Furthermore, data from IDC indicates that the growth rate of NAND flash memory supply is projected to be only 17% in 2026, which falls below the average levels witnessed in recent years. This limitation on supply could play a significant role in shaping market prices and availability.

Strategic Outlook

Regardless of whether the production cuts executed by Samsung and SK Hynix are viewed as a proactive strategic adjustment or a reactive move necessitated by technical transitions, observers suggest that 2026 could be a pivotal year for these companies in optimizing their production benefits. The targeted approach to curtailing NAND flash memory output appears to strategically position them against low-cost competitors.

As the industry navigates these shifts, the ramifications for consumers and businesses alike will become increasingly pronounced. The delicate balance between supply and demand will continue to shape the landscape of the NAND flash memory market, with potential implications for pricing, availability, and ultimately, innovation in storage technologies.

By aligning their production strategies with market realities and competitive pressures, Samsung Electronics and SK Hynix are poised to safeguard their profitability while contending with the evolving demands of sectors reliant on high-performance storage solutions.