### Summary

– NVIDIA has officially ceased testing Intel’s 18A process, leading to a 5% drop in Intel’s stock price.

– Despite this setback, Intel’s CEO emphasized that the 18A process was primarily intended for internal products.

– The future of Intel’s foundry business hinges on the upcoming 14A process, developed for external customers.

—

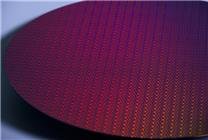

Intel’s foundry business has encountered significant turbulence following NVIDIA’s recent decision to terminate testing of the 18A process, a move that contributed to a 5% decline in Intel’s stock price just before the market opened. This decision underscores ongoing market challenges and highlights the competitive dynamics facing Intel in the semiconductor industry.

### The Fallout from NVIDIA’s Decision

The announcement regarding NVIDIA’s withdrawal from the 18A process came as a shock to many, given the earlier enthusiasm surrounding Intel’s plans. When Intel introduced the 18A process two years ago, speculation ran rampant about the interest from major players in the technology sector, including Qualcomm and Apple. Even NVIDIA’s CEO, Jen-Hsun Huang, acknowledged their involvement, albeit framing it as merely a testing phase.

With NVIDIA stepping back, it appears that Intel will no longer pursue partnerships regarding this generation of processes. However, it’s crucial to note that this development may not be as dire as it seems. Intel’s CEO, Chen Liwu, previously indicated that the 18A process was primarily designed for internal use, focusing on producing chips for its own PC and server products.

### Looking Ahead: The 14A Process

The core of the conversation now shifts to the prospects of the upcoming 14A process. This next generation of fabrication technology is being poised to attract external clients, having been crafted in collaboration with various customers from the outset. Recent feedback from trial runs has been overwhelmingly positive, with reports suggesting a smoother development process compared to the early phases of the 18A.

Importantly, while NVIDIA’s retreat from the 18A process could suggest potential challenges, it also opens doors for further collaboration on evolving technologies. NVIDIA may still explore testing the enhanced version of the 18A process, known as 18AP, or shift its focus toward the promising 14A process. The need for diverse foundry options beyond TSMC is critical in enabling companies like NVIDIA to optimize production costs and address demands for domestic manufacturing.

### A Competitive Market Landscape

Intel’s struggle is not merely technical; it’s fundamentally about market positioning. As the company competes with other manufacturing giants in CPUs, GPUs, and AI chips, it finds itself in a complicated situation where prospective partnerships often line up with its direct competitors. This contrasts starkly with TSMC’s business model, which focuses solely on foundry services without the added layer of competition among clients.

In this high-stakes environment, Intel’s ability to redefine its foundry offerings is critical. The success of the 14A process can pave the way for renewed partnerships and help stabilize its market position. However, there exists a risk that external customers may not fully embrace either the 18A or the upcoming 14A, which could further complicate Intel’s future in the foundry sector.

### Conclusion

As NVIDIA pulls back from the 18A process, the spotlight now turns to Intel’s forthcoming 14A technology. The shift in strategy not only reflects the complexities of partnerships in an increasingly competitive semiconductor landscape but also underscores the importance of innovation and collaboration. How effectively Intel navigates these challenges will ultimately determine its success in regaining footing in the foundry market.