Japan’s Push for 2nm Chip Production: Rapidus on Track for 2027

Summary:

- Industry Pioneers: TSMC, Samsung, and Intel lead the world in 2nm chip production, with Japan’s Rapidus set to join by 2027.

- Key Developments: Rapidus is focusing on establishing a comprehensive semiconductor manufacturing process, including back-end packaging and testing capabilities.

- Market Challenges: The success of Rapidus depends on business viability and a clear demand for advanced AI chips in a competitive global landscape.

On January 9, Fast Technology reported a significant development in the semiconductor manufacturing landscape. Currently, only three companies—TSMC, Samsung, and Intel—are capable of mass-producing chips using advanced 2nm processes. However, Japan’s Rapidus aims to be the fourth player in this elite group by 2027.

Advancements and Upcoming Milestones

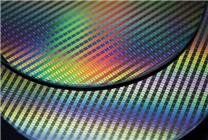

Rapid advancements are crucial for Rapidus as it prepares to roll out its 2nm processes. Following the successful demonstration of 2nm wafers last July, the company is now focused on establishing an extensive industry chain. This spring, Rapidus plans to set up a 9,000-square-meter research facility at the Seiko Epson Chitose Plant, marking a significant leap toward fulfilling its ambitions in semiconductor manufacturing. The upcoming phase will involve the initiation of back-end processes, specifically chip packaging and PCB circuit assembly.

The back-end process, known as Back-End of Line (BEOL), represents the stage of semiconductor manufacturing dedicated to packaging and testing. Unlike in previous years, where front-end and back-end processes could be handled separately, the increasing complexity of advanced chips necessitates integrated production capabilities. As a result, back-end processes are now pivotal to the successful launch of sophisticated semiconductor products.

Industry Dynamics and Competitive Landscape

In recent years, TSMC has emerged as a leading production house for AI chips, largely due to its cutting-edge manufacturing technologies and innovative packaging solutions like CoWoS. This exclusive capability has made TSMC indispensable for companies such as NVIDIA and AMD, underlining the escalating importance of back-end processes in today’s semiconductor industry.

Japan faces a dual challenge; not only does it lag in advanced chip-producing capabilities, but it also lacks the sophisticated packaging and testing infrastructure necessary for a complete manufacturing system. Rapidus is thus compelled to independently develop this comprehensive supply chain. The successful trial production of back-end processes this spring will pave the way for mass production of 2nm chips. If packaging solutions fall short, Japan may have to rely on foreign manufacturers, which would hinder its progress.

Financial Support and Future Prospects

Assuming Smooth operations and execution, Rapidus appears well-positioned to achieve its goal of mass-producing 2nm technology by 2027. The firm collaborates with IBM for technical expertise, and access to EUV lithography machines and etching equipment remains unencumbered. Financially, the company is buoyed by a substantial investment of 7 trillion yen, with the Japanese government contributing approximately 1.7 trillion yen in subsidies.

However, challenges remain. The ultimate success of Rapidus depends heavily on the underlying business framework. Japan’s ambitions to master advanced semiconductors are clear, yet critical questions persist: Who will utilize these 2nm chips, and for what applications? If Rapidus becomes merely a foundry, it will face intense competition with TSMC and Samsung over costs and production volumes, making its journey even more arduous.

Market Demand and Global Competition

For Japanese firms to capitalize on a domestic 2nm production capability, they must focus on developing advanced CPUs, GPUs, and AI chips. However, current trends indicate that Japanese companies have yet to showcase well-known models in the AI sector or actively engage in the production of competitive AI chips. This lack of innovation creates significant uncertainty regarding market demand, which is essential for sustaining profitable operations in a highly competitive, globalized landscape.

In conclusion, while Rapidus’s efforts to cement Japan’s position in the advanced semiconductor market are commendable, the company’s future hinges on effectively navigating complex technological, financial, and market challenges. As Rapidus embarks on this ambitious journey, successful execution and clear demand for innovative chip solutions will be critical factors to monitor in the coming years.