Summary:

- NVIDIA’s $5 billion investment in Intel signals a new era of competition, particularly challenging for AMD.

- AMD acknowledges the strategic challenges posed by this alliance, especially in pricing and product positioning.

- The company remains committed to innovation and competitive pricing, aiming to enhance market dynamics for consumers.

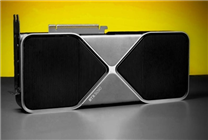

AMD Faces Heightened Competition as NVIDIA and Intel Join Forces

On November 9, industry reports highlighted a significant move in the tech sector: NVIDIA has announced a substantial investment of $5 billion into Intel. This collaboration aims to jointly develop cutting-edge processing products for PCs and data centers. Analysts and industry insiders have quickly recognized the implications of this alliance, forecasting increased competitive pressure on AMD.

In its recent third-quarter financial report, AMD acknowledged the challenges stemming from the partnership between NVIDIA and Intel. The company described the dual economic and strategic impacts this collaboration brings, asserting that the market is becoming "intensely competitive and rapidly evolving."

One notable concern for AMD is the potential weakening of its leading position in the APU processor segment, particularly within the handheld market. The financial report notes that Intel is pursuing aggressive pricing strategies, leveraging its stronghold in the microprocessor market to attract AMD’s customers and channel partners. Such tactics are likely to reduce AMD’s sales volume and average selling prices, thereby adversely impacting its business prospects.

AMD articulated the challenges posed by NVIDIA as well, emphasizing its significant market presence in data center GPUs and the advantages granted by its proprietary software ecosystem, such as CUDA. This creates a landscape in which AMD is under increasing pressure as it attempts to carve out its niche within the data center and gaming markets.

Despite the fierce competition, AMD remains a robust player. Over recent years, AMD has stabilized its operations and solidified its market position. Its processors boast substantial advantages across various applications, and the company has made considerable strides in data center GPU technology. Nevertheless, the alliance between Intel and NVIDIA presents a noteworthy obstacle for AMD, particularly when considering Intel’s market share dominance.

NVIDIA, with a market capitalization of $5 trillion, remains a formidable competitor, boasting strong technical and financial resources. The company’s GPU products lead the gaming and AI sectors, further complicating AMD’s landscape.

The collaboration between NVIDIA and Intel will yield two primary product lines: a consumer-grade Core processor equipped with an integrated RTX GPU and a custom AI-focused processor for data centers. Although these products are still under development and will require market testing, their impending release is expected to have a significant impact on AMD’s competitive stance.

In its report, AMD expressed concerns regarding the intensified competition and pricing pressures stemming from NVIDIA’s partnership with Intel. The company foresees that this dynamic could negatively affect its financial health and profit margins.

However, there is a silver lining. AMD has expressed a proactive stance, welcoming the competition as a driving force for innovation within the industry. The company is committed to adopting more competitive pricing strategies that should not only enhance its market position but also provide consumers with a broader array of choices.

Conclusion

As the tech industry continues to evolve, the partnership between NVIDIA and Intel marks a pivotal moment for AMD. While the challenges may seem daunting, AMD’s focus on innovation and competitive pricing may secure its future in a dynamic marketplace. The ensuing competition could ultimately be beneficial, enriching the choices available to consumers and spurring advancements across the industry.