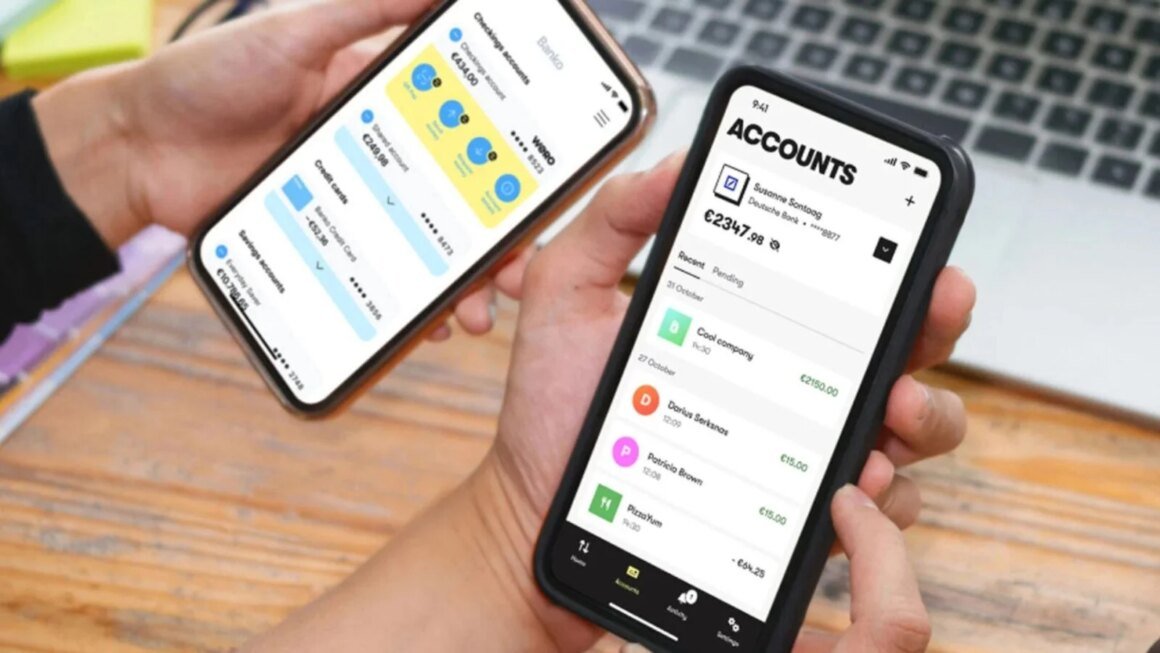

Wero is set to debut in 2024 as a new peer-to-peer payment solution designed to provide an alternative to American giants like Visa and MasterCard. Developed by the European Payments Initiative, Wero aims to offer a cross-border payment system for users within the EU by facilitating money transfers between individuals via bank accounts, email, phone numbers, or QR codes. This initiative comes at a time when Europe is increasingly looking for self-sufficient payment systems due to growing concerns over the dependence on U.S. financial services.

This launch matters especially for consumers and businesses engaged in cross-border transactions across Europe. With Wero, users can make seamless payments directly from their bank accounts, enhancing convenience and potentially diminishing fees associated with traditional international payment methods. While currently available in France, Belgium, and Germany, Wero’s expansion to other EU countries is expected soon, promising a more integrated European payment landscape.

Market-wise, Wero enters a competitive field populated by existing solutions such as PayPal, Apple Pay, and traditional cards like Visa. While American services dominate the landscape with established infrastructure, Wero positions itself by emphasizing lower transaction fees and greater regulatory alignment with EU laws. For smaller merchants, the prospect of reduced costs and easier payment integrations may present a compelling alternative to existing payment processors. However, businesses currently using international platforms may hesitate to switch until Wero demonstrates long-term reliability and widespread adoption among consumers.

Wero may be appealing for consumers looking for an efficient, European-based payment alternative that circumvents traditional card networks. It may also attract small businesses desiring lower payment processing fees. However, those who are accustomed to the extensive networks and services offered by established players like PayPal or Visa may find Wero less enticing, especially if they rely heavily on features unique to these platforms. Additionally, its success depends on merchant adoption, which remains to be fully realized.

Source:

www.01net.com