Summary

- Samsung Electronics and SK Hynix are set to ramp up investments in advanced NAND production due to surging demand from the artificial intelligence sector.

- Both companies aim to initiate significant upgrades to their NAND capacity in Q2 2023, with plans to enhance production in existing facilities.

- The shift from DRAM to NAND investment anticipates a tighter supply in the NAND market, driven by increasing consumer demand.

Samsung and SK Hynix Target Advanced NAND Production Expansion

On February 3, reports emerged confirming that Samsung Electronics and SK Hynix are ready to fully launch their investments in cutting-edge NAND technology. This strategic move comes in light of the rapidly rising storage demands spurred by the booming artificial intelligence industry. Both companies have delayed previous plans, primarily due to dedicated resource allocations toward DRAM.

Accelerated Investment Plans

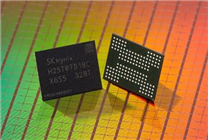

Industry insiders indicate that Samsung and SK Hynix are planning a "conversion investment" in advanced NAND production set to commence in the second quarter of this year. Samsung’s recent foray into the market includes the mass production of 280-layer V9 NAND, which began in September 2024. However, current production capabilities remain modest, with an output of around 15,000 wafers per month. Notably, Samsung had previously opted for a preliminary mass production line at its Pyeongtaek Park, primarily guided by market demand considerations.

Moving forward, Samsung is poised to significantly increase its V9 production capacity starting in Q2 2023, focusing on the X2 manufacturing line in Xi’an, China. This specific production line has been predominantly focused on older 6th to 7th generation NAND chips, although the adjacent X1 line is nearing the completion of its conversion to 8th generation NAND technology.

Expansion and Future Production

Recent discussions within the industry suggest an anticipated conversion investment scale of approximately 40,000 to 50,000 wafers per month. As new equipment is continually integrated, Samsung’s V9 NAND is expected to reach a mass production acceleration phase in 2024. Originally, Samsung aimed to initiate V9 conversion activities at the X2 production line in early 2023; however, this timeline has now shifted to Q2. Additional preparations are underway at Pyeongtaek First Park (P1), signaling a notable increase in V9 product output in the coming year.

Similarly, SK Hynix is also advancing its goals for expanding its advanced NAND production footprint. The company intends to begin its conversion investment for 321-layer 9th-generation NAND in Q2 2023, targeting a production capacity of around 30,000 wafers per month at its Cheongju M15 factory. This marks a significant leap from its current capacity of approximately 20,000 wafers.

Shifting Market Dynamics

Industry experts observe a critical transition as both Samsung and SK Hynix proactively adapt to increased demand for advanced NAND technology. Historically, equipment investments from these corporations have heavily favored DRAM, but current market conditions indicate a possible shortage in NAND supplies. This proactive expansion signifies both companies’ commitment to meeting rising consumer and industrial needs for efficient storage solutions.

As the semiconductor landscape evolves, the strategic focus on NAND production reflects a broader trend in the tech industry. The integration of AI technologies necessitates higher performance storage capabilities, prompting major players like Samsung and SK Hynix to realign their investments to capture this growing market segment.

Conclusion

In summary, the anticipated investments from Samsung and SK Hynix signal a significant shift in the semiconductor market. As they ramp up production capabilities in advanced NAND technology, these firms not only aim to satisfy the immediate demands associated with artificial intelligence but also position themselves for long-term growth in an increasingly competitive market.

The advancements in production lines, increased wafer capacities, and strategic planning underline the importance of NAND technology in shaping the future of digital infrastructure. With these developments, Samsung and SK Hynix are set to become pivotal in addressing the rapid growth of storage needs in the coming years.