Industry Insights: Persistent Memory Shortages and Future Predictions

Key Takeaways:

- Huang Chongren, chairman of Power Semiconductor Manufacturing Co., Ltd., notes unprecedented memory shortages in his 30 years of experience.

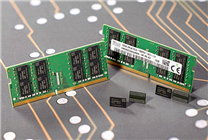

- Major manufacturers are shifting focus from traditional DRAM to more profitable high bandwidth memory (HBM).

- Full supply recovery may not occur until at least 2028, according to industry forecasts.

In a revealing interview, Huang Chongren, the chairman of Power Semiconductor Manufacturing Co., Ltd., addressed the critical challenges currently facing the semiconductor industry. In a market characterized by unprecedented storage shortages and soaring prices, even seasoned professionals are grappling with uncertainty. Huang, who has over three decades of experience in the memory sector, stated that he has never encountered a situation quite like this before, emphasizing the stark reality of the ongoing crisis.

"This is the first time I have seen this phenomenon in my 30 years of working in memory," Huang remarked. "I cannot foresee when the gap between supply and demand will be resolved."

As technological advancements, particularly in artificial intelligence (AI), continue to drive demand, Huang painted a concerning picture for the future of memory supply. He underscored that the need for memory is unlikely to diminish as long as AI technologies evolve and proliferate.

Power Semiconductor specializes in logic wafer foundry and memory manufacturing. Recently, the company has benefitted from a super cycle, with DRAM foundry revenue experiencing significant growth—rising from under 40% to 45% within just one quarter. This trend aligns with broader industry movements indicating robust demand for memory components.

Huang noted a corresponding surge in Power Semiconductor’s stock price, which has reportedly climbed over 300% in the past six months. Such impressive growth reflects not only the company’s strong market position but also the increasing demand for semiconductor products across various sectors.

However, Huang’s outlook regarding the replenishment of memory supplies is far from optimistic. He mentioned that leading manufacturers like Samsung, SK Hynix, and Micron are opting to produce high bandwidth memory (HBM) instead of traditional DRAM. Given the higher profit margins associated with HBM, this shift further stretches the availability of conventional memory products.

"I don’t think the shortage is that easy to solve," he stated. "The investment in building new factories and expanding capacities is simply not keeping pace with demand."

Huang also addressed the possibility of an AI bubble that could potentially alleviate pressures on memory supplies. Currently, he does not foresee such an event materializing. Referring to predictions from Micron, he indicated that some improvement might be seen by 2028. However, the notion of a complete resolution to the memory shortage is still far off.

In summary, the current landscape of the semiconductor industry is characterized by a confluence of factors contributing to severe memory shortages. A combination of escalating demand driven by AI advancements and strategic shifts among major manufacturers has led to a challenging environment for memory production. As industry experts like Huang Chongren highlight, the path towards recovery is complex and fraught with uncertainties, calling for a keen eye on future developments and innovations in the sector.

The insights shared by Huang signal a crucial need for ongoing analysis and adaptability within the industry, urging stakeholders to stay informed and prepared for the evolving landscape of semiconductor manufacturing.