Summary

- Dongxin Co., Ltd. has released its 2025 performance forecast, anticipating a net loss between 174 million and 214 million yuan.

- Despite losses, the company reported a 43.75% year-on-year increase in operating income and achieved profitability in its storage segment.

- The firm plans to invest significantly in GPU development, with promising results from its self-developed GPU chip, 7G100.

Dongxin Co., Ltd. Projects Future Growth Amid Losses

Dongxin Co., Ltd. recently published its performance report for the fiscal year 2025, revealing a complex financial landscape. Although the company is poised to incur a net loss between 174 million and 214 million yuan, its leadership remains optimistic about long-term growth.

Revenue Growth and Profit Margins

During the reporting period, Dongxin experienced a remarkable 43.75% increase in operating income compared to the previous year. This growth is noteworthy in the context of the company’s evolving business strategy, which has not only improved its gross profit margins but also led to profitability within its storage segment. The efficient operational changes and strategic focus are signs that Dongxin is positioning itself for a stronger market presence.

The management team attributes this financial improvement to a combination of increased product demand and effective cost management strategies.

Strategic Investment in GPU Development

As part of its forward-looking strategy, Dongxin plans to invest an impressive 200 million yuan in Shanghai Lishuang during 2024. This investment is aimed at bolstering the company’s technological capabilities and is expected to yield significant returns as developments progress.

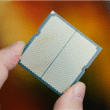

A highlight of this initiative is the introduction of the 7G100, Shanghai Lishuang’s first self-developed GPU chip. Successfully "taped out," the 7G100 has already begun to see limited delivery to customers, signaling the commencement of mass production and widening sales efforts. This chip, built on a cutting-edge 6nm process, showcases Dongxin’s commitment to advancing in the GPU market, with initial performance tests exceeding that of competitors like NVIDIA’s RTX 4060.

Continued Investment and Market Introduction

In addition to the aforementioned funding, Dongxin will allocate another 211 million yuan in 2025 to further solidify its standing in the high-performance GPU arena. The company utilizes the equity method for these investments, forecasting an investment loss of approximately 166 million yuan for the year. This financial strategy reflects a long-term vision, prioritizing innovation and technology advancement over immediate profitability.

The upcoming consumer version of the 7G100 is highly anticipated, although specific details regarding its stock volume, pricing, and launch date have yet to be disclosed by the official channels.

Embracing Domestic Innovation

Dongxin’s approach not only underscores its commitment to cutting-edge technology but also highlights the importance of domestic development in China’s rapidly evolving electronics market. The self-sufficiency in chip design fosters innovation and sets a competitive benchmark for the industry.

The 7G100 represents a significant leap for Dongxin as a homegrown company, showcasing its capability to design and produce advanced technology independently. This move is not just beneficial for Dongxin; it also contributes to the broader narrative of enhancing China’s position in the global technology landscape.

Conclusion

In summary, while Dongxin Co., Ltd. faces financial challenges as evidenced by its projected losses, the company’s strategic investments and robust growth in operating income indicate a brighter future. The focus on developing the 7G100 GPU chip positions Dongxin as a pivotal player in the high-performance computing space. This commitment to innovation reflects a broader trend of domestic technology advancement, reinforcing the notion that challenges can often serve as a catalyst for transformative growth.

As Dongxin navigates these complexities, it will be intriguing to observe how its strategies will unfold in the coming years and the impact they will have on the broader tech industry.