TSMC’s Ascendance: Profits Surge with EUV Technology

Summary:

- TSMC’s implementation of EUV lithography has led to significant profit increases, with a 3.3-fold rise in earnings.

- The price for advanced 2nm wafers has surpassed 200,000 yuan, showcasing TSMC’s market dominance.

- TSMC’s strategic pricing and technology leadership continue to distance it from competitors like SMIC, Samsung, and Intel.

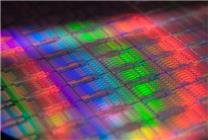

In recent years, TSMC (Taiwan Semiconductor Manufacturing Company) has solidified its position as the leading wafer foundry in the semiconductor industry, particularly following the introduction of EUV (Extreme Ultraviolet) lithography technology. This pivotal shift, marked by mass production starting in 2018 and a substantial ramp-up in 2019, has yielded remarkable benefits for the company, as evidenced by a significant rise in both performance and profitability.

A detailed analysis of TSMC’s average selling price (ASP) of wafers reveals a dramatic transformation that can be divided into two distinct phases: the years from 2005 to 2019, and the post-2019 period. Prior to 2019, TSMC saw minimal growth in wafer ASP, with an increase of just $32 over a span of 14 years, reflecting a compound annual growth rate (CAGR) of merely 0.1%. During this same timeframe, costs of goods sold (COGS) mirrored this stagnation.

However, a remarkable shift occurred after 2019. During this period, TSMC’s ASP skyrocketed by 133%, translating into a CAGR of 15.2%. In contrast, COGS experienced a more modest increase of 10.1%, resulting in profits that surged 3.3 times in comparison to previous years.

Before 2019, TSMC’s pricing strategy allowed for a selling price increase of only $1.43 for each dollar of cost. Following 2019, this ratio saw dramatic improvement, with $1 in costs correlating to a $2.31 increase in selling price, subsequently leading to a tripling of profits.

The rise in demand for advanced semiconductor technology has stirred major adjustments in the global supply chain. Particularly noteworthy is the COVID-19 pandemic’s role in exacerbating demand for chips, which subsequently buttressed TSMC’s market lead in advanced manufacturing capabilities.

Recent reports indicate that the average ASP for TSMC wafers has ascended to approximately $7,000. For perspective, SMIC’s (Semiconductor Manufacturing International Corporation) financial reports indicate an ASP of only $924 per wafer—less than one-seventh of TSMC’s benchmark.

The remarkable ASP of TSMC can be attributed to its cutting-edge technology, which allows for advanced manufacturing processes. Notably, 2nm wafers produced by TSMC are projected to command a price of $30,000 (over 200,000 yuan)—more than four times the average price of its standard offerings. Such advancements underline TSMC’s ongoing competitive edge and leadership in semiconductor technology.

Furthermore, TSMC has recently announced plans for incremental price increases over the next three years. Reports suggest that the foundry price for the A16 wafer might witness a staggering 50% hike, approaching $45,000 each.

Given these pricing strategies, it’s no surprise that many manufacturers are seeking alternative partnerships with other companies such as Samsung and Intel. Nonetheless, these competitors struggle to match TSMC’s robust technology and production capacity. As a result, TSMC faces minimal resistance against price increases, and even major clients such as Apple and NVIDIA are finding themselves limited to negotiating discounts without impacting their overall spend significantly.

In conclusion, TSMC’s strategic advancements in EUV technology and its methodical pricing tactics have vastly improved its profitability and market positioning. As the semiconductor landscape continues to evolve, TSMC’s dominance remains firmly entrenched, underscoring its pivotal role in shaping the future of technology.

By leveraging advanced technologies and strategic pricing, TSMC is not just thriving but also setting benchmarks in the semiconductor industry, leaving competitors struggling to keep pace.