Summary

- The U.S. has shifted its export policies on AI graphics cards, creating a mixed landscape for companies like AMD and NVIDIA.

- Despite potential revenues from recent exports, the financial impact on these companies may be minor compared to their overall earnings.

- The U.S. strategy appears aimed at inhibiting the growth of domestic AI chip firms, but this effect may only be temporary.

The ongoing evolution of the United States’ export policy regarding AI graphics cards has been anything but predictable. Over the past year, significant fluctuations have marked these policies, reflecting complex motivations and concerns from U.S. officials.

The U.S. Dilemma: Profit vs. Competition

On one hand, the U.S. seeks to capitalize on its domestic technology to maintain industry dependence. However, there is a prevalent fear that exporting AI chips to international markets could enhance the capabilities of foreign companies, particularly those in China. This fear is heightened by the emergence of robust domestic AI models that have started to challenge U.S. companies by leveraging open-source technologies.

Recently, a subtle relaxation in export restrictions has allowed companies like NVIDIA to sell H200 graphics cards and AMD to confirm the MI308 graphics card’s entry into the market, although the status of AMD’s MI300 series remains uncertain.

Projected Revenues: A Closer Look

The anticipated financial gains from exporting these graphics cards have caught the attention of analysts. For AMD, the MI308 graphics card presents a potential revenue stream of approximately $500-800 million. Reports suggest that major domestic internet corporations are poised to procure between 40,000 and 50,000 units of these chips at a possible price of $15,000 each, creating an impressive revenue generation scenario.

Conversely, NVIDIA stands to gain even more substantial revenues, with projections estimating between $7 billion and $12.5 billion from the H200 graphics cards sales. This revenue is expected to yield earnings of $0.15 to $0.30 per share in the upcoming year.

Export Tax Implications

Despite these promising figures, both AMD and NVIDIA must contend with hefty export taxes ranging from 15-25%, which could significantly diminish their net profits from these transactions. Consequently, combined revenues from these exports may settle around $10 billion—equivalent to roughly 70 billion yuan. While this figure offers a substantial income stream, it pales in comparison to NVIDIA’s current quarterly revenues, which exceed $60 billion and exhibit strong growth potential.

Market Dynamics and Future Challenges

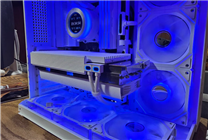

The export opportunities brought forth by U.S. policy adjustments will have notable ramifications in the domestic AI chip sector. Currently, no local companies can match the scale of AMD or NVIDIA’s offerings, positioning the U.S. firms to retain a competitive edge, albeit temporarily.

Moreover, U.S. policies may inadvertently stifle the domestic AI chip industry. Domestic firms, reliant on local technology and collaborative software optimization, face an uphill battle competing against foreign products that, despite their impending revenues, may not significantly enhance U.S. technology leadership over the long haul.

As domestic chip technology rapidly advances, analysts predict that a pivotal shift may occur by 2027, when local capabilities could bolster the domestic AI sector, mitigating the impact of U.S. export strategies.

Conclusion

The recent adjustments in U.S. export policies for AI graphics cards signify a nuanced and strategic calculus, aimed at maximizing economic benefit while attempting to curtail foreign competition. Although AMD and NVIDIA are set to realize immediate financial gains, the longer-term implications for the domestic AI industry could pave the way for transformative changes in technological development and market dynamics.